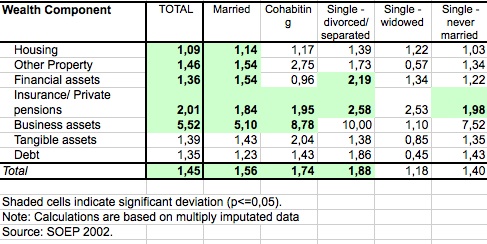

A main obstacle to the analysis of gender wealth gaps in the empirical literature is the lack of comprehensive information at the individual level. Using data from Germany, we find clear empirical indications of a significant raw gender wealth gap of about 30,000€, which amounts to almost 50,000€ for partners in married couples

A main obstacle to the analysis of gender wealth gaps in the empirical literature is the lack of comprehensive wealth information at the individual level (Deere and Doss, 2006). This gap in the literature is tackled using the 2002 wealth module of the German SOEP. We find clear empirical indications of a significant raw gender wealth gap of about 30,000€, which amounts to almost 50,000€ for partners in married couples (see table 1). We use various decomposition method and find a robust picture of the wealth gap being mostly driven by differences in characteristics between men and women. By far the most important factor in explaining these differences is the individual’s own income and labor market experience particularly for the bottom and top of the wealth distribution. Differences for those in the middle of the distribution appear to be mostly driven by the way in which women transform their characteristics into wealth, i.e., the wealth function.

Wealth accumulation is a result of past assets, current income and consumption and the rate of return. Gender differences in wealth accumulation can occur due to differences between men and women in any of the above factors. First, of all men and women differ in the attachment to the labor market with women working more in low-paid part-time jobs and consequently this causes lower wealth accumulation for them via lower earnings. Women are also believed to have lower preferences for risk and invest more conservatively, which on the one hand causes lower returns, but on the other hand shelters them from higher risk exposure at times of economic downturns. Other factors that are believed to affect wealth accumulation are probability for homeownership, family structure and difference in marriage patterns with women getting married at a younger age compared to men.

In some countries, there may be little concern of a gender wealth gap within couples as divorce laws in many EU countries ensure an even split of assets (1). Nevertheless, a difference in wealth holdings among partners will most likely affect (or be a result of) intra-partnership bargaining power thus affecting individual well-being as is the case for income (Pahl, 2001). In addition, an existing wealth disadvantage before marriage would be perpetuated when individuals enter into partnerships with existing wealth holdings as these are not subject to a 50-50 split after divorce. It should also be noted that such 50-50 divorce laws are not the standard in all countries and certainly not in the US where common law states are a minority. This is of utmost relevance given the specific functionality of wealth and only emphasizes the importance of analyzing the gender wealth gap, specifically within couples. In addition, divorce may be the last step that finalizes the lack of cooperation within the household and those with more wealth usually have more bargaining power.

Table 1: Relative Gender Wealth Gap (Men/Women) based on avarage wealth holdings

--

(1) The legal regulations in Germany and many other European countries consider joint ownership of assets (and debts) only for those wealth components acquired during marriage. Wealth accumulated prior to marriage will remain in the hands of the original owner and will not be affected by a divorce. Inheritances during marriage are also not considered to be accumulated jointly and thus will remain fully in the hands of the successor. However, this is true for the (monetary value) of the original inheritance only and excludes eventual capital gains or added value. Marriage contracts can also be designed to deviate from these standard regulations in divorce law. Thus, in order to examine whether there exists a gender wealth gap it is important to know which partner actually owns a specific asset given that in case of a divorce only the jointly accumulated wealth will be evenly split among the partners.